How to monetize your product or service is a critical and difficult question, especially for increasingly digital business models. Today we explore how to develop monetization logics by combining pricing strategies and revenue models.

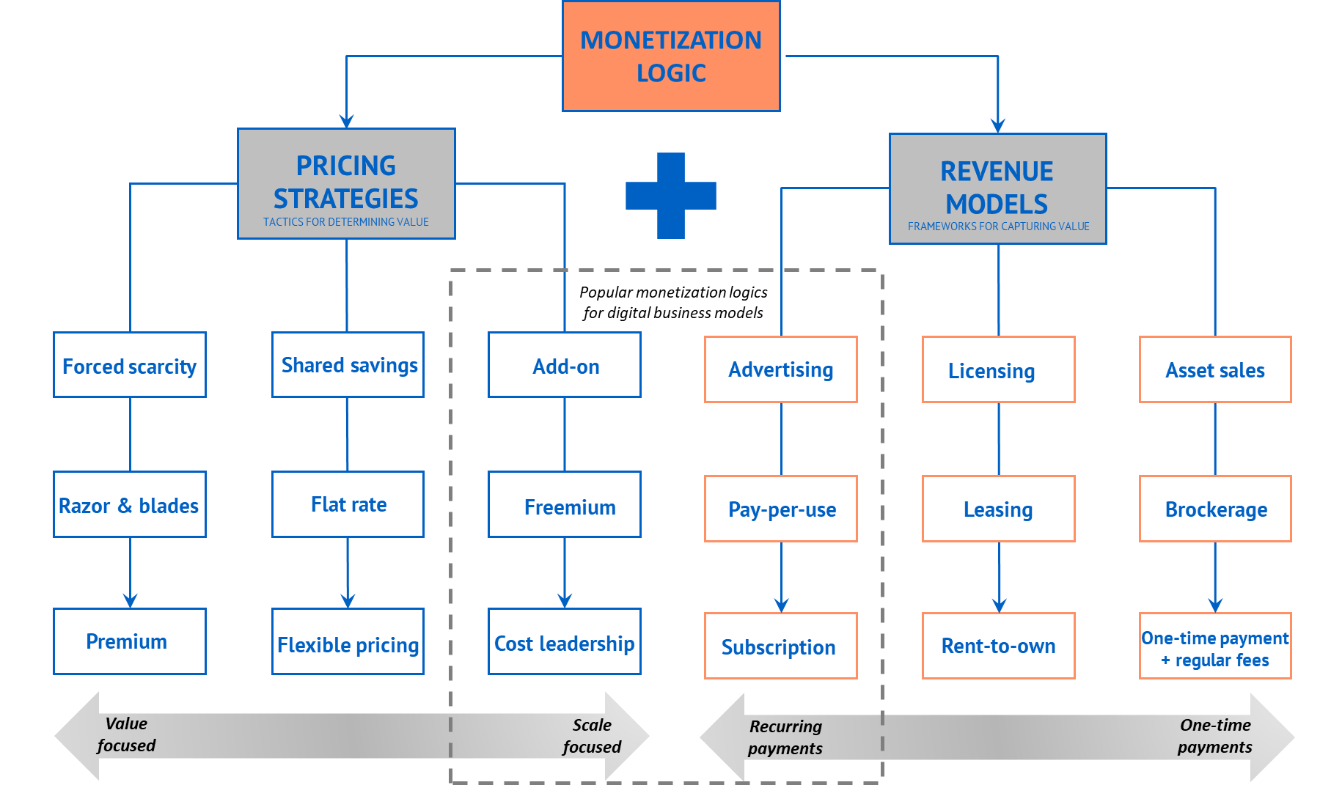

Unfortunately, many people confuse revenue models (R) and pricing strategies (P). A revenue model is a selected framework for how a business will generate income – i.e. the way money is charged; while a pricing strategy is the selected way to maximize profits.

When you think about your monetization logic, you actually first need to be clear about your pricing strategy. In the ideal case, this flows directly from your business strategy. Do you want to focus on scale and target a broad market or do you focus on value and target a niche market? Second, you need to think about the revenue model: Are you going to charge your users one time or do you charge recurrently? Bear in mind that the latter requires you to provide value on an ongoing basis!

See below the Monetization Logic Framework. On the left side you see popular pricing strategies ordered by their focus. On the right side you see common revenue models, ordered by their payment recurrence. A good monetization logic combines these two building blocks. Particularly the six elements in the middle are often used for digital business models. Let’s take a look at two companies and how they configured their monetization logic.

Tinder

Let’s first zoom into Tinder. What is the monetization logic of the dating app? It follows a freemium strategy (P) and combines advertising (R), and subscription (R). Freemium is an incredibly famous pricing strategy used by many digital services like Dropbox, MailChimp, or Skype where basic services are offered for free and a premium price is charged for special features.

The freemium strategy allows Tinder to attract a large group of people on their platform. Freemium combines free and premium services. For free users, Tinder uses – like most community-based apps – advertising to generate revenues. This revenue model is also used by Facebook, Instagram, and Snapchat where a free service is provided in exchange for targeted advertising. How? Tinder camouflages sponsored content and advertisements from various brands and events in the form of profiles. When users show their interest in a sponsored profile by swiping right, they are instantly matched and receive a pre-drafted message from the sponsor with whom they can either chat or follow the given link.

For premium users, Tinder goes a step further using subscription to create an exclusive experience to a growing base of loyal users. This is a common revenue model used by Netflix, Spotify, and most recently YouTube where a recurring payment (or monthly or yearly) is charged to unlock access to offerings and services that non-members do not have. How? In 2015 Tinder launched Tinder Plus, offering access to various special features. Following Tinder Plus’s success came Tinder Gold, essentially an extension of Tinder Plus with an extra feature that allows users to see how many likes they have and who has shown interest in their profile. Although this feature is part of the Tinder Plus and Gold subscription pack, it can also be purchased as a stand-alone feature for standard users (Add-on).

Ryanair

Let’s look at the monetization logic of Europe’s largest low-cost airline. Their special formula: flexible pricing (P), add-ons (P) and asset sales (R). This allows Ryanair to fill its planes at a load factor of close to 95% and make profits in an industry that is notorious for being unprofitable. Let’s take a look behind the scenes.

As any other airline company, Ryanair uses asset sales to generate revenues. This is a common revenue model used by all airline companies when they charge one-time for a ticket with a margin. As a pricing strategy, Ryanair is using flexible pricing. This is a common pricing strategy used by most airline companies, but by low-cost carriers such as EasyJet, Vueling, and Wizz air in particular. Flexible pricing means that fares for tickets vary depending on demand. Yet, this is not why Ryanair is profitable. In fact, Michael O’Leary, Ryanair’s CEO, has even considered the possibility of allowing passengers to fly with Ryanair for free within the next decade.

So how does Ryanair make money? Ryanair uses the add-on pricing strategy: that means they charge high margins on multiple extras. Everything from carrying baggage, selecting a seat, sending your e-ticket to your phone, priority boarding, fast track through security, and credit card fees at the time of checkout is heavily charged. It accounts for about 22% of Ryanair’s total revenues.

So this is the Brain Snack of the week. If you enjoyed this content, please comment, follow us, and share this post! Also, you can explore more ways for business model innovation on www.smartbusinessmodeler.com.

Excited to bring your business idea to market?

Sign up now for bite-sized units, templates, and tools that guide you on the art of venture creation

All this, and a lot more – for free!