The startup financing cycle is one of the most challenging aspects of launching a new business. How do you evaluate your startup liquidity? How do you measure your startup funding needs? Calculate your answer to these questions with our three-step-model below or with our new Cash Flow Calculator tool!

After selecting your target market, determining your unique value proposition, deciding how to create and deliver your product/service, and understanding how you will generate revenues, it is time to pull everything together and mobilize the needed resources to bring your venture to market. As you start to develop your business and position it in the market, while still in the absence of revenues from sales, cash will only flow one way – out!

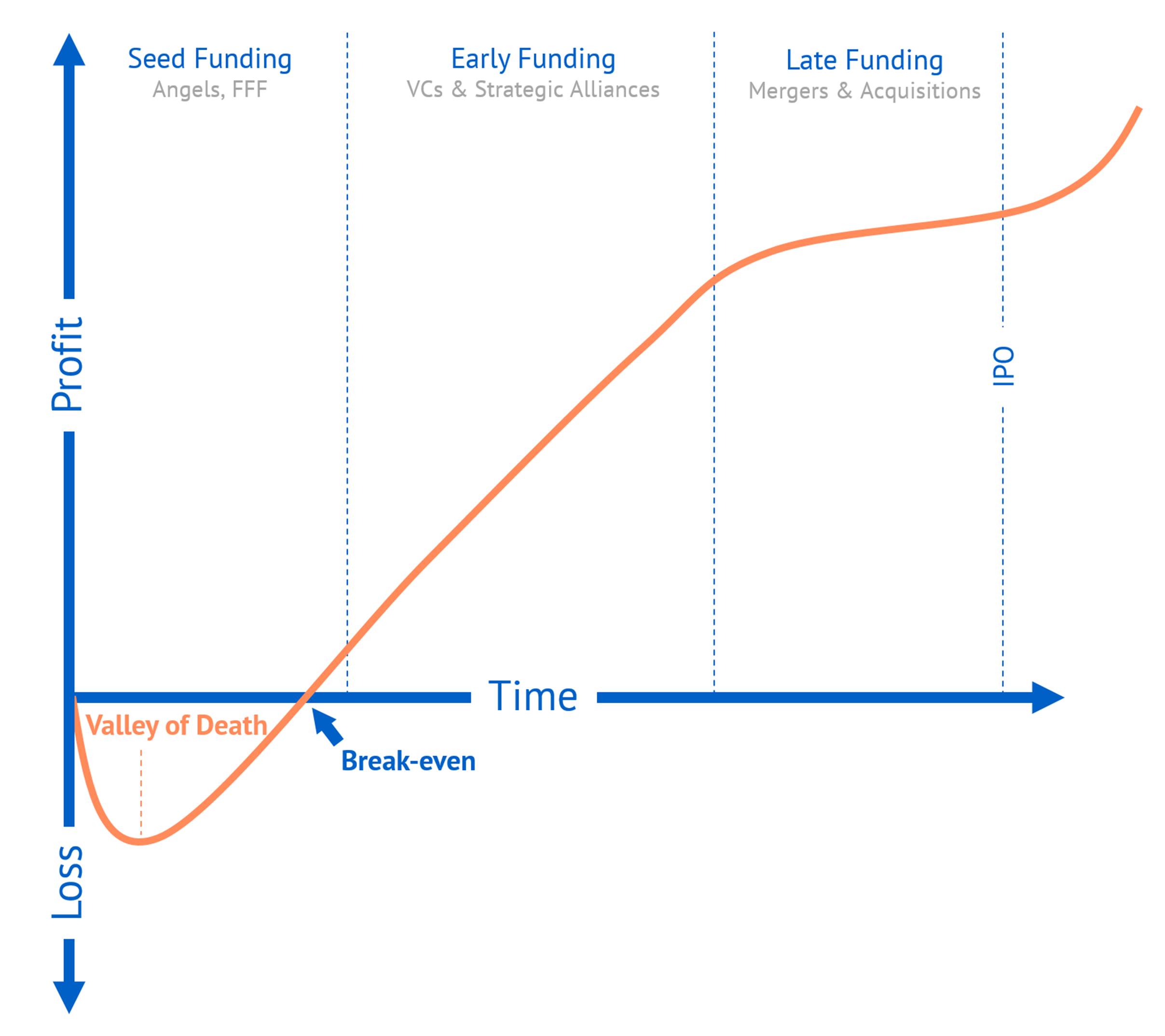

Startup Valley of Death

A startup’s Valley of Death is a financial projection graph that predicts the moment(s) in time where the startup will have difficulty covering the negative cash flow, before growing a significant customer base. This is a valuable projection because it helps entrepreneurs estimate their funding requirements to survive the early-stage periods of negative cash flows.

How to calculate the Valley of Death? Although essential, cash flow calculations are generally far from intuitive. To help you measure the liquidity of your business opportunity we developed the three-step-model to manage the Valley of Death.

Step #1: Start with the break-even point

Measuring your break-even point is a great way to estimate the minimum price per unit, the minimum quantity of units sold per month, and the minimum hours of work you will need to put in per day just to generate enough revenues that cover your businesses fixed and variable costs – i.e. zero profit.

To have a realistic yet simple overview of how your cash inflows and outflows will look like for your business’ first months, you can assume zero interest, zero depreciation, and zero taxes, providing that all numbers considered exclude VAT. Once you come back to these items, consider an “Interest Rate” of around 10% and “Income Taxes” of 30%.

Next, think about the fixed costs associated with running your business during a period of one month. For instance, you should include your team’s monthly wages, your monthly marketing costs, and you should consider if you will need an office or a place to store stock (monthly rent). Naturally, other fixed costs that you cannot yet foresee might come up. As a rule of thumb, include a buffer of 25-30% of the sum of all the fixed costs that you can predict as “Other Overhead Costs”. Summing all these fixed costs (personnel, marketing, rent, and others) yields to your minimum Gross Margin. The higher the Gross Margin, the higher the profit on each dollar of sales.

Next, you should estimate the monthly cost of sales. This might seem a little confusing in written form, so we map it all out below. Essentially, we start with what you [should] already know:

- The Costs to produce and sell each unit (C = € 20)

- The assumed Gross margin ratio (GMR = C / P = 1/2 ß rule of thumb)

- The Price at which you sell each unit (P = C x GMR = €40)

- The minimum Gross margin (GM = personnel + marketing + rent + other = € 14,500)

Now you want to know the minimum quantity of units sold and the monthly costs of sales:

- Minimum quantity of units sold per month (N)

- The monthly cost of sales (COGS = N x C)

N = GM / (P – C) = € 14,500 / (€ 40 – € 20) = 725

COGS= N × C =725 × €20 = € 14,500

Finally, what are the minimum monthly sales to reach break-even? Again, let’s start with what you already know:

- Gross margin ratio (GMR = C / P = €20 / €40 = ½ = 50%)

- Monthly cost of sales (COGS = N x C = € 14,500)

And what you want to know:

- Minimum monthly sales to reach break-even (S)

S = COGS / (1-GMR) = € 14,500 / (1-1/2) = € 29,000

Wrapping it all up, in order to afford the fixed and variable monthly costs of running this business, without losing money, you would have to generate €29,000 monthly sales (excluding VAT).

Step #2: Expectations setting

What do €29,000 of monthly sales mean to your daily life? Once you are aware of the minimum monthly sales goal, it is time to sit down with the team and set expectations on how many units must be sold per day (NWD) and per team member (NTM), and on how many hours each team member must contribute per day (LTM) in order to achieve that monthly goal. Let’s start with what you know:

- The time you need to produce and sell one unit (L = 1h)

- The days you will work in a month (WD = 24d)

- Your number of team members (TM = 3)

NWD = N / WD = 725 / 22 = 33 (units sold per day)

NTM = NWD / TM = 33 / 3 = 11 (units sold per team member)

LTM = NTM X L = 11 x 1 = 11 (minimum monthly hours worked per team member to break even)

How attractive does this business opportunity look to you on a daily basis? Are you confident about your ability to not only meet these minimum monthly goals but also to surpass them and steadily grow your month-on-month profitability?

Step #3: Startup Funding = Startup Valley of Death + 20%

Achieving break-even in one month is, of course, the exception and may take much longer. In that case, you need to have sufficient funding for the Valley of Death because running out of cash means closing the company. How do you make sure you have enough funding? You can apply for grants, awards, or funding from business angels. Consider a realistic monthly growth rate in sales and re-work the previous formulas to evaluate different scenarios of achieving break-even in three months, in six months, or maybe even in nine months. What is important here is to be conscious of the “Valley of Death” period you will be crossing and to plan for it by applying for grants, awards, or other forms of initial funding that can support your costs of doing business during this initial stage on negative cash inflows.

A good rule of thumb for measuring how much to ask for funding or to which challenges to apply is to sum all negative cash flows until your break-even point and add 20% on top. The result is your initial funding need.

If these are too many formulas for you, check out our new Cash Flow Calculator tool that automatically measures:

- Cash balance. The total amount of money in your bank account, at a given time.

- Break-even point. Your best estimate for when you will be able to cover all the initial expenses and start making a profit.

- Funding needs. Your initial capital needs to help you bridge the valley of death and cover the negative cash flows during your startup’s early months.

How to survive the Startup Valley of Death?

After forecasting your valley of death period and being clear on how much funding you will need, it is time to prove to investors that you have the ability to manage limited resources in a profitable way. Here is a collection of best practices to bridging the valley of death.

Before Launching your Startup

- Develop a complete financial plan and present it to a couple of trusted business mentors for feedback on how realistic or ambitious your financial projections are.

- Apply to your industry-specific startup challenges for prizes, awards, and grants.

- Launch a crowdfunding campaign to request donations, pre-order, or offer equity.

After Launching your Startup

- Plan your days, nights, and weekends to maintain a monthly fixed salary, at least until you achieve break-even, and work only part-time on your venture.

- Find one major customer who would benefit greatly from your offering and commit to meeting their requirements and offering dedicated support.

- Exchange services for services. For instance, let us take the example of a platform. You might not have a working platform, but you should have the content, logic, and knowledge for why your platform will revolutionize your industry. As you cannot sell your platform yet, sell your services as a speaker, a mentor, a workshop facilitator to validate your platform’s offering, to get the word out that your platform is coming soon, and to start generating revenues to further develop the platform.

So this is the Brain Snack of the week. If you enjoyed this content, please comment, follow us, and share this post! Also, you can explore more ways for business model innovation on www.smartbusinessmodeler.com.

Excited to translate your business idea into a scalable business model?

Simply sign up now to access our bite-sized units, templates, and tools that guide you through the art of creating and testing winning business models.

All this, and a lot more – for free!