Scalability has become a buzzword, yet not everyone understands what a scalable business model actually means and few understand the actual drivers. In this brain snack, we close that gap.

Growing vs. Scaling

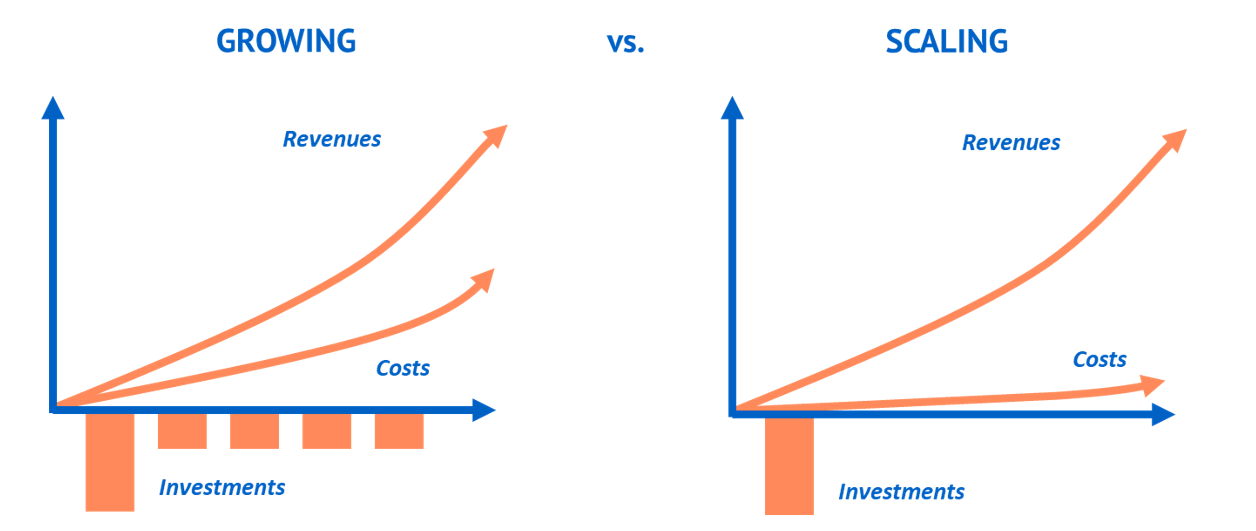

Scalability as such refers to the degree to which revenues can be increased without proportionally increasing investments in production or infrastructure. In other words, scalability is about increasing productivity, creating more output with the same input. Particularly internet business models are rather scalable because digital technologies are immaterial and therefore almost infinitely scalable. Imagine you invested in a website and created a business model for selling coffee online, it is often irrelevant whether you sell 500 bags of coffee or 5000, the only costs that (may) increase our variable marketing costs. Thus, the difference between growing and scaling is that growing refers to investing in resources at the same rate as you are increasing revenues and scaling refers to exponentially increasing revenues without investing in new resources (see the illustration).

Drivers of Scalability

But how do you create a scalable business model? First, you need to understand the drivers of scalability. The main ones are:

Light asset base – this refers to the degree to which you have heavy or light investments. Heavy investments such as production plants lead to lower scalability, light investments such as a website lead to higher scalability. Firms can make their asset base lighter through outsourcing. Think about how sharing business models such as Airbnb have outsourced their asset base to homeowners.

Automated processes – the degree to which you can automize processes influences your scalability. The more you can automize, the better you can scale. Particularly in the area of logistics, there are many opportunities for automation, for instance in the area of online retail Amazon offers many solutions to fully automize sales and logistics.

Low-cost labor – the degree to which your business model is integrating high or low-cost labor influences scalability. Business models that rely on low-cost labor such as ride-hailing (uber) are more scalable than for instance consulting services that have high labor costs.

Prepare for replication – the degree to which your business model can be replicated in other markets influences scalability. Business models that are less dependent on culture or regulation are easier to scale.

Dangers of Scaling

Although investors love scalable business models, beware – scaling may not be everything and can also have disadvantages. A nice analogy is if you think about an image you take with your smartphone. If you zoom in too far, quality decreases. This can also happen with scaling. Scaling too fast can lead to a decrease in quality for the customer and hurt the company in the long-run.

A well-known example of scaling too fast is Groupon which grew too fast, hurting customer experience. Also, having a scalable business model means also less complexity which lowers barriers to entry and attracts competition. This often leads to capital intensive battles for leadership and existence. This can be observed with the many eScooter and bicycle sharing firms entering the market. Last, a problem occurs when ‘scaling’ is used to drive growth instead of scaling being a result of growth. An easy example: if you hire people to sell more products you may run into so-called premature scaling. If you sell more products and you need to hire more people you did everything right.

This is the Brain Snack of the week. If you enjoyed this content, please comment, follow us, and share this post! Also, you can explore more ways for developing scalable business models on www.smartbusinessmodeler.com.

Excited to bring your business idea to market?

Sign up now for bite-sized units, templates, and tools that guide you on the art of venture creation

All this, and a lot more – for free!