As we have learnt in the last Smart Hub Article, one of the things to be considered for the business to generate incremental growth is the amount of capital. Therefore, the financial plan is an important task. Your balance sheet is where you want to get to see what your business is worth.

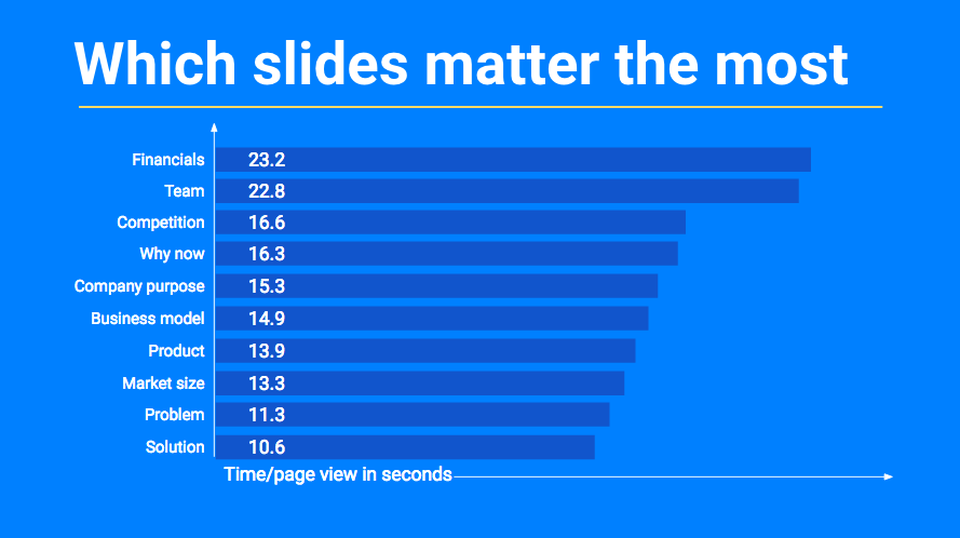

Financial planning and forecasting are a look into the future starting today, based on educated guesses rather than unrealistic details. This is the slide where investors spend more time analyzing than on any other. According to Forbes review of 200 funded startups, investors spent more than double of the time on “Financial” slides than on “Problem” and “Solution” slides of the pitch.

The purpose of a financial plan is two-fold. For you, financial projections are critical to assess the viability and scalability of your business, to measure your progress and set milestones for yourself. For investors, financial projections are a credibility and intelligence test to verify if you understand the basics of growth dynamics, business costs as well the competitive environment.

Financial projections are not about accuracy and details, but rather about how realistically and clearly you present your train of thought for your next 3 years. “Projections are meant to be dynamic and flexible tools” where you can easily change one driver and instantly see the overall impact in all related components. This is what allows you to consider different scenarios and approaches, rather than to focus on one particular scenario that eventually will become obsolete.

Your financial plan

Forecasting the future of something that is yet an idea is hard. Luckily, enough brave ones have walked this dreadful path to leave some guidelines on the art of financial planning. Startup financial planning consists of 5 documents:

- Startup Costs Worksheet

- Income Statement

- Cash Flow Statement

- Balance Sheet

- Break-Even Analysis

Startup Costs Worksheet. This is a “Day One” statement of all the purchases you will need to make in order to open your doors for business, consisting of the following three columns: Expense Title, Expense Description and Expense Amount (in €).

Income Statement. This is essentially a snapshot of your business where you will show your expenses, revenues and profits, on a monthly basis, in order to verify the feasibility of your idea.

![]()

Cash Flow Statement. This proves your business’ ability to meet monetary commitments by detailing the cash position, firstly, on a monthly basis, and after the first year, on a quarterly basis. Cash flow projections consist of:

- Cash Inflow: the estimates or expected monthly sales;

- Cash Outflow: the expected monthly expenses;

- Cash Flow Reconciliation: summing up all cash inflows and subtracting all cash outflows to arrive at the cash flow balance, which will then be carried over to the next month.

Balance Sheet. This is a snapshot of what your business is worth where everything your business owns is added up, all debts are subtracted and the resulting difference shows the net worth of the business – the owners’ equity value.

Break-Even Analysis. This analysis reveals when you will be able to cover all the initial expenses and henceforth start making a profit (Break Even Point = Fixed Costs / [unit selling price – variable costs])? A breakeven analysis will help you understand:

- Is your current product/service profitable?

- How low could sales drop before you start incurring losses?

- How much of sales (in €) is required for you to start making profit?

- What is the impact of reducing unit selling price or volume of sales on profits?

- If fixed costs increase, how much would price or volume of sales have to increase?

Questions your financial business plan must survive

Investors are not interested in the precision of your numbers, but rather on what the numbers reveal about your understanding and the economic of your business. To be credible, your numbers must make sense on the first view and survive simple questioning:

- Do the capital requirements match the funding you are asking?

- How many customers do you have to retain to generate the revenues you are projecting?

- How long does it take and how much does it cost to acquire a customer?

- What resources will be required to support customers?

- How much will you have to spend to stay ahead of the competition with your product/service offering?

Excited to translate your business idea into a scalable business model?

Simply sign up now to access our tutorials, videos and tools that guide you through the art of creating and testing winning business models.

All this, and a lot more – for free!